.webp)

The Red Cod Forge Gallery in Nanoose Bay will host an event the weekend of Dec. 6 and Dec. 7 that will feature demonstrations by four blacksmiths. The gallery show, which runs from 10 a.m. to 5 p.m. on both days, will support Nanoose Community Services, with 10 per cent of sales, according to owner and blacksmith Dave Kasprick. The event will feature three artists: Kasprick (blacksmithing and sculpture), Debra Kasprick (mixed metal art jewelry) and Kelly Corbett (realism painter). There will be blacksmithing demos on both days by four blacksmiths. The gallery will also be collecting warm items for Manna Homeless Society, such as toques, socks, gloves and foil emergency blankets. Anyone who makes a purchase or donates a warm item will be entered for a chance to win a one-of-a-kind Red Cod Forge sculpture. “Help us help out our favourite local community projects during this season,” Kasprick said. Red Cod Forge Gallery is located at 2155 Spur Pl. in Nanoose Bay. RELATED: Nanoose Bay blacksmith crafts lifelike octopus sculpture [https://pqbnews.com/2025/01/30/nanoose-bay-blacksmith-crafts-lifelike-octopus-sculpture/]

NOV. 29-30 Parksville and District Rock and Gem Club: Seventh annual Rock and Gem Show, Qualicum Beach Civic Centre, 747 Jones St., Qualicum Beach. 9:30 a.m. to 4:30 p.m. Saturday, 9:30 a.m. to 4 p.m. Sunday. $4 per person, children under 12 free with an adult. Free hourly draws, demonstrations of lapidary and jewellery, wide variety of vendors, silent auction, concession, kids activity centre. Family friendly, something for everyone. DEC. 3 Cookies, Carols and More!: Get ready for a magical afternoon filled with holiday cheer at the annual Cookies, Carols and More! event. Mark your calendars for Saturday, from 2 p.m. to 4 p.m. and gather your kids, families, friends, and neighbours to join in the festivities and fun at the Jensen Centre (132 Jensen Avenue East, Parksville). DEC. 6 Craig Bay Choristers: Present ‘Born in Bethlehem’, 2:30 p.m. at Knox United Church, 345 Pym St., Parksville. A varied program of traditional and spiritual classics such as ‘Children, Go Where I Send Thee’ and ‘The Peace Carol’ with a message of hope, faith and peace. Seasonal and fun selections, too, as we sing ‘It’s A Marshmallow World’ and perform ‘The Holiday Tango!’ Directed by Lonnie Moddle, accompanied by Andrea Lahmer. Tickets $20 (12 and under, free) available from Fireside Books (cash only) 464 Island Hwy E., Parksville or by advance request to cbchoirconcerts@gmail.com. We support Oceanside Hospice. Christmas on the Farm: Little Qualicum Cheeseworks (403 Lowry’s Rd. Parksville), 10 a.m. to 3 p.m. Admission: By donation (suggested $5 per person). Bundle up and and enjoy a range of kid’s activities, Christmas crafts, storytelling, live music, wagon rides, holiday shopping, food, and hot drinks. Festive fun for the whole family! Parking at Morningstar Golf Course to catch a wagon ride to the farm. Accessible parking will be available in our main parking lot. Admission proceeds donated to the local Food Bank. Info: https://cheeseworks.ca/pages/events/christmas-on-the-farm. Bradley Christmas Artisan Market: 10 a.m. to 3 p.m., Bradley Centre, 975 Shearme Rd, Coombs. Free admission, free parking, raffle, food truck. Celebrate the holiday season with a truly special shopping experience at this carefully curated event, featuring a selection of talented local artisans offering unique, handcrafted gifts perfect for everyone on your list. Proceeds benefit Bradley Centre Programming. Help us stock the Community Cupboard – bring a non-perishable item for our donation box. DEC. 14 Christmas Cantana: ‘This is Christmas’; Celebrating the heart of Christmas is taking place at St. Stephen’s United Church in Qualicum Beach, 2 p.m. Admission by donation to Salvation Army food bank. ONGOING Rotary Club of Parksville: New members welcome. Club meets at the Parksville Community Centre, 223 Mills St., every second and fourth Wednesday from 5:30 p.m. to 7 p.m. Weekly Bottle Drop, every Saturday from 10 a.m. to 2 p.m. at Speedy Glass in Parksville. All recyclable bottles, cans and milk cartons accepted, with funds raised going back into the community. Info: www.parksvillerotary.ca. Holiday Market Series: Dec.6, Dec. 13, Dec. 20; 8:30 a.m. until noon, Veterans Way and the Community Hall in Qualicum Beach. Discover beautiful handcrafted artisan items, prepared foods, beverages, fair-trade chocolate, seasonal baked goods, wreaths, and table centrepieces from local Vancouver Island vendors. Join us at our free weekly farmers market, showcasing a variety of local small businesses. Support your community while finding the perfect gifts! Rest assured, all items are made by local Vancouver Island makers, bakers, and growers. Milner Christmas Magic: Dec. 4-7; 11-14, 18-21 from 5 p.m. to 8 p.m., with viewing until 8:30 p.m. Admission is by donation. 2179 Island Highway W, Qualicum Beach. Make memories with your loved ones this holiday season by experiencing Milner Christmas Magic – an outdoor stroll through thousands of twinkling lights and festive window displays! Our woodland garden comes alive with this spectacular light exhibit, and remember to enhance your visit by purchasing a pair of Holiday Specs, holographic glasses that miraculously transform lights into magical figures. Gingerbread Gift Shop plus selection of hot food and refreshments for sale in front of Milner House. Info: milnergardens.viu.ca/special-events. Royal Canadian Legion Qualicum Beach Branch 76: Open 1 p.m. to 7 p.m., seven days a week; Cribbage, Mondays, 1:30 p.m. in the lounge; Ladies Pool, Tuesday, 1 p.m. and Drop-in pool Monday-Thursday, 1 p.m.; Euchre, Tuesdays, 1:30 p.m. in the lounge; Casual Fridays, 6 p.m. Meat Draws – Friday & Saturday from 4-6 p.m. in the lounge. Mexican Train – Thursdays 1 p.m. Monthly Birthday Celebration: second Wednesday of the month, 4 p.m. Bring appies, cake served; Duplicate Bridge – Monday and Friday, 12:30 p.m. to 4 p.m. in the hall. Music Bingo: Dec. 15. Food 5-7 p.m., Music 6-8 p.m. Upcoming events: Honours and Awards, Nov. 30, 1 p.m.; Christmas Dinner with gift exchange, Dec. 7, 5 p.m.; New Year’s Eve Party, Dec. 31. Royal Canadian Legion Bowser – Branch 211: Winter hours: Wednesdays through Saturdays, lounge opens at 3 p.m. Wednesdays: Ladies Pool and Cribbage – 4 p.m. Thursdays: Men’s Pool and Darts – 6 p.m. Meat Draws – Fridays at 5 p.m. and Saturdays at 4:30 p.m. Snooker – Sundays at 2 p.m. Live Music Jams, second and fourth Fridays each month. Info: 250-757-9222; www.rcl211.org; rcl211@shaw.ca. Members, guests and prospective members always welcome. Royal Canadian Legion Mt. Arrowsmith, Branch 49 Parksville: A community-based service organization offering social and recreation activities plus weekly lunch and dinner specials. Guests welcomed to drop in and see what we’re about. Tuesday: Canasta –1 p.m., Wednesday: Cribbage –1:15 p.m., Drop-In Dance Nights 7-9 p.m. Thursday: Euchre 1 p.m., Dominoes/Mexican Train–1:30 p.m. Friday: 10 Card Crib –1 p.m. Saturday: 8-ball mixed doubles Pool–11 a.m., Meat Draw 3-5 p.m. Book a private function, or community event. Catering available. Office: 250-248-5633 between 8:30 a.m. to 2:30 p.m., Monday to Friday. Qualicum Beach Farmers Market: A vibrant hub of local commerce and community connection. Join us every Saturday, 8:30 a.m. to noon, on Veterans Way, throughout the year, for a diverse assortment of vendors. The market also features live music, children’s activities, and food trucks, creating a lively atmosphere that’s enjoyable for all ages. Save-on-Foods/ Parksville Lions: FREE Family Skate; sessions on Sundays, from noon to 1:30 p.m. include ice rental, free loaner skates, loaner helmets and learn-to-skate aids. Costs are covered by generous donations from local businesses and organizations such as naming sponsor Save-on-Foods, Coastal Community Credit Union, Island Self Storage, Mid-Island Co-op, ParksWest Business, Riptide Graphics, Sunbelt Rentals, Wallpepper Designs and MLA Stephanie Higgins. No sessions Dec. 14, 21 and 28. Oceanside Breast Cancer Support Group: Have you received this devastating diagnosis? We can help. As breast cancer doesn’t take a break neither do we. We meet on the first Thursday of every month at 1 p.m. in the Community Meeting Room of The Gardens in Qualicum Beach. Info: Lorraine, 250-954-2393. Oceanside Mixed Badminton Doubles Group: New members welcome; play twice a week, every Tuesday and Thursday from 1 p.m. to 3 p.m. in Coombs at Arrowsmith Hall. Cost to play is $8 per person per session. Info: Sandi at cambren1@telus.net. Qualicum Run Club: New outdoor fitness club for slow pace women – friends, fitness, coffee! Ongoing year-round, running every month in all weather. Includes athletic conditioning, structured beginner fitness program and fun active community for women who ‘hate running!’ We meet Mondays, Wednesdays and Fridays from 9-10 a.m., adding new times as we grow. Membership is $150/month. Licensed, experienced, and insured. Welcoming women with pace 8:30 min/km and slower (13-20 min/mile), we run 2-3 miles in the hour on mostly urban routes. Register at qualicumrunclub.ca. Oceanside Women’s Business Network: Did you know there’s a women’s dinner and networking group here in Oceanside? If you’re a woman in business looking to grow your community and network, we’d love to have you join us! The OWBN meets once a month, on the third Tuesday of the month, 5:30 p.m. to 8 p.m. Reach out to info@owbn.ca for more details. Info: www.owbn.ca. Little Qualicum TOPS: Group meets every Tuesday at 10 a.m. at the Qualicum Beach Civic Centre in the Booth room. New members are always welcome. All attendees weigh-in from 10 to 10:15 followed by a program from 10:15 to 10:55. If you are interested in losing weight and require help, TOPS is here for you. Take Off Pounds Sensibly. Oceanside Photographic Society: General meetings on the first Wednesday of each month in the West Hall of the QB Civic Centre. Meetings begin at 7 p.m. and run until 9:15 p.m. and include a coffee break. If you have an interest in the photographic arts and want to socialize with and learn from others that share your passion and interests please join us. Info: oceansidephotographers.ca Arrowsmith Needle Arts Guild: This group of embroiderers meets twice monthly in Parksville. Stitchers at all levels are welcome to come and explore all types of stitches, new ideas and make new friends. Meetings details from Lynda at 250-927-4015 and/or Moyra at 250-248-7108. Parksville Community Centre: Men’s Coffee and Conversation drop-in every Tuesday 10 a.m. to noon by donation. Women’s Coffee and Conversation drop-in every Friday 10 a.m. to noon by donation. Oceanside Orcas MS Support Group – MS Canada: Is MS new to you or someone you know? Or have you been coping for years and want a space to meet like minded folks to share experiences? Then this might be the group for you. We meet on the third Friday of every month, in person, in Parksville. Please contact MS Canada staff to learn more and join. Phone: 1-844-859-6789 Email: msnavigators@mscanada.ca. Website: https://mscanada.ca/find-support/ms-support-groups/vancouver-island-oceanside-ms-support-group. Oceanside Caregivers: Meet the last Thursday of each month at 1 p.m. at The Gardens Long Term Care, 650 Berwick Rd., North, in Qualicum Beach. We bring support by way of understanding, caring and resources, in a confidential setting. Info: 250-752-2104 or caroldowe@gmail.com. Parksville/Qualicum Fish & Game: The Dorman Shotgun Range is a fully licensed, well-equipped shooting range located on Dorman Road in Qualicum Beach. Shooters young and old at all levels of expertise are welcome. Practice shooting for Trap and Skeet are scheduled Sundays at 10 a.m. and every even-numbered Wednesday at 11 a.m. 100 Men of Oceanside: Group meets quarterly and its members commit to contribute $100 individually at each meeting to support an eligible Oceanside charitable group. Members’ individual donations of $100 quarterly ($400 per year) are issued federal tax receipts by the recipient organization and 100% of member donations goes to the selected charities. Actively recruiting new members. Info: 100oceansidemen.ca or email info@100oceansidemen.ca. PGOSA: We’re outdoors for hiking, biking, walking and talking, and indoors for line dance, card games, wood carving, badminton, curling, slo-pitch, volleyball, pickleball, walking soccer and more talking! If you’re 55 or older and live in Oceanside, Parksville Golden Oldies Sports Association is for you. Join online at PGOSA.org, or at the membership table at Oceanside Place Arena some Wednesdays from 9:30 a.m. to 11 a.m. – check our website for dates. Only $5 for the balance of 2025! Parksville Lawn Bowling Club: Drop-in activities through March 2026; Mahjong Mondays (Chinese version) 7 p.m. Cost is $2 per person per visit. Crib on Wednesdays, 1 p.m. start, $4 per person. Thursday is Bridge Day, 1 p.m., $2 per person. Info: parksvillelawnbowlingclub.com. Oceanside Stroke Recovery Society: Providing therapy and support to stroke survivors and their caregivers. Meets Fridays at St. Columba Church Hall, 921 Wembley Rd., Parksville at 11 a.m. Info: 250-586-6766. Qualicum Beach Museum: Now open Saturdays from 1 p.m. to 4 p.m. ‘Learning Saturdays’ are great for families with children, and include a child-focused activity with a different theme each month. Info: 250-752-5533. Parksville PROBUS Club: We are a group of retirees enjoying friendship and fun activities for singles, couples and especially newcomers in Parksville. We are a very friendly bunch and have awesome guest speakers plus a broad range of interesting activities and social events. We meet at 9:15 a.m. on the third Monday of most months in the Parksville Community Centre, 223 Mills St. Visitors are welcome. $5 entrance fee covers coffee and light refreshments. Info: probusmembershipchair@gmail.com or call Lila 250-816-2708. Nov. 17: Guest speaker will be Xander France, Director of Sales and Marketing for Vancouver Island Ferry Company (Hullo Ferries). He will be discussing “Hullo Ferries: Past, Present, and Future,” sharing insights into the concept, design, and operation of the walk-on ferry service from Nanaimo to Vancouver, which became operational in 2023. Qualicum Beach PROBUS Group: We are an active social group of retired and semi-retired seniors which meets on the first Tuesday each month at 9 a.m. at St. Stephen’s Church (150 Village Way, Qualicum Beach). We have a variety of interesting and diverse speakers and several special interest groups. We welcome guests interested in exploring, joining us and meeting new friends. Check out our activities at www.qbprobus.com. NWB PROBUS Club Nanoose Bay: First Friday of each month. Please join us at 9:15 a.m. at St. Mary’s Church Hall 2600 Powder Point Rd. Meet new friends over coffee and goodies and enjoy interesting speakers. $5, coffee and goodies during social time. Visitors/new members welcome. Info: nwbprobus.org. Lighthouse Community Hall: 240 Lions Way, Qualicum Bay. Second Sunday of each month a local charity hosts our Open Market (8 a.m. to noon) and Pancake Breakfast (8 a.m. to 11:30 a.m.). For information on table rentals contact Barb: vendors@lighthousehall.ca. Pancake breakfast contact the office: admin@lighthousehall.ca or 778-424-9900. Arbutus Toastmasters: Find your voice and learn how to use it with confidence, kindness and meaning, in a safe, supportive environment. No experience necessary. Guests are welcome. We meet every Monday, 7-9 p.m. at 249 Hirst (Parksville Inclusion Bldg). www.arbutus.toastmastersclubs.org for more info or call Kristin at 250-248-1926. Qualicum Beach and Area Newcomers: Meet the second Tuesday of every month, 10 a.m., at St. Stephen’s Church Hall, 150 Village Way, Qualicum Beach. All residents welcome. Info: qbnewcomers.org. Oceanside Newcomer Alumni Society: Monthly meetings are the third Tuesday of the month at St. Stephen’s Church in Qualicum Beach at 10 a.m. Info: 250-917-8122. Seated Tai Chi: Tuesdays 10:30-11:30 a.m., Nanoose Place (Committee Room), Nanoose Bay. Helpful for everybody, and especially students with health and mobility issues. While seated in class, students learn movements which help to increase circulation, as well as to improve joint mobility, and to stretch the tendons and ligaments. Info: 778-744-0413; midislandtaichi.org. By donation. Parksville Shores Tai Chi: Every Tuesday and Thursday. Continuing classes. Done Tai Chi before? This is for you, come and join us. 9:30-11:30 a.m. $25 a month or $60 for 3 month. Knox Church 345 Pym St., Parksville. Info: www.parksvilletaichi.com. Coronation Street Social Club of Oceanside: Meets September through June on the second Thursday each month at Rotary House (corner of Fern Road and Beach Road in Qualicum Beach), 1:30 to 3:30 p.m. If you are looking for a fun, social group come and join us for lively talk, shared stories and meet new friends. Don’t need to be a fan of the show, all that’s required is a sense of humour. Tea, coffee and refreshments will be served. Info: 240-594-1965. Coombs Rodeo Grounds: Pancake Breakfast and Flea Market, the first Sunday of each month. For table rentals, call Val at 250-752-9735. Open Mic Music Night on the third Friday of each month September through May; 7 p.m.; kids and musicians free, adults $5. Coffee and snacks available. More info: 250-927-2747. Smart Recovery: Meetings are Saturdays at 10 a.m. and Wednesdays at 6:30 p.m. Women’s Only meeting on Tuesdays at 6:30 p.m. All meetings at 245 Hirst Ave. W. Info: 250-586-3727. Oceanside Orcas MS Support Group – MS Canada: Is MS new to you or someone you know? Or have you been coping for years and want a space to meet like minded folks to share experiences? Then this might be the group for you. We meet on the third Friday of every month, in person, in Parksville. Please contact MS Canada staff to learn more and join. Phone: 1-844-859-6789 Email: msnavigators@mscanada.ca. Website: https://mscanada.ca/find-support/ms-support- Oceanside Wood Carvers: Meet every Thursday morning 9 a.m. at Qualicum Elementary School (699 Claymore Rd.) shops room throughout the school year. Enter from the west end side door to woodworking room on left. Experienced and new carvers are welcome. Info: Bob at 250-586-8689. Victoria’s Quilts: Making quilts for cancer patients. Meeting every third Tuesday of the month September to June, 9:30 a.m. 3ish at Nanoose Place Community Centre 2925 Northwest Bay Rd. New sewers welcome all supplies provided. Info: koolpj43@shaw.ca. Parksville Tops 985 Weight Loss Support Group: Meetings, Wednesday at 6:15 p.m. Weigh-in, 5-6 p.m., Parksville Seniors Drop in Centre 144 Middleton Ave., Parksville. Parking and enter from the alley entrance. Info: Liz, 250-954-1809. TOPS (Take Off Pounds Sensibly): Qualicum 4754 is a weight-loss non-profit support group. We meet every Tuesday morning from 10 a.m. to 11 a.m. at 184A, Second Ave W, Qualicum. Meeting includes a weigh-in and program. Info: Janice 250-738-6220. Oceanside Chess Club: Meet on Saturdays from 11 a.m. to 3 p.m. at St. Marks Church, 138 Hoylake Rd W., in the basement. No cost to attend; small donations appreciated. All welcome. Qualicum History Tours: Historical walking tours with an experienced local guide leave every Tuesday from the Qualicum Beach Museum. $20 per person. Info: 604-754-4465. Qualicum Beach Seniors’ Activities Centre: 703 Memorial Ave., Qualicum Beach. SUNDAYS: Contract Bridge, 1 p.m. MONDAYS: Knitting in Lounge/crocheting for Manna, 9:30-11 a.m. Yoga, 9:30-10:30 a.m., Chair Yoga, 11 a.m.-noon, Qualicum Beach Ukulele Band, 12:30-2:30 p.m., Beginner Ukulele in Lounge, 3-4 p.m., Line Dance I, 3-4 p.m., Line Dance II, 4-5 p.m., Ballroom dance practice, 5-6 p.m., TUESDAYS: Fun Bridge, 9 a.m. -noon., Group of 8 in lounge Full 9-10 a.m., Whist 12:30 to 3 p.m., WEDNESDAYS: Hatha Yoga, 10-11:15 a.m., Fun With Chaz Guitar in lounge, 12:30 -1:45 p.m., Spanish Conversation, 11:30 a.m. -12:30 p.m., Chair Yoga, 1-2 p.m., Book Club in the Lounge, 2-3 p.m., Drawing & Painting, 2:30 – 4 p.m., Qwest, 3:15-5 p.m. Beginner Line Dance 5:30-6:30, Dance practice 7 p.m.-9:30 THURSDAYS: Beginner Bridge Lessons, 9:30-11:30 a.m., Darts – 10 a.m-12:15 p.m., Technology Tutor in Lounge, 1:30 -3:30 p.m., Drop-in Bridge, 12:00-3 p.m. Line Dancing, 4-5 p.m., Ballroom Dance, 5-6 p.m., Dance Practice, 6-7 p.m., FRIDAYS: Ukulele Friday, 10 a.m. – noon., Classic Guitar 10 a.m.-noon., Mahjong in the Lounge, 1-3 p.m., Art, 1-3 p.m. SATURDAYS: Hatha Yoga With Richard, 9:45 to 11 a.m., Qi Gong 11:15 a.m. to 12:15 p.m. Overeaters Anonymous: Have you tried to control your eating, your weight, and nothing has worked? Join Overeaters Anonymous, we are recovering compulsive overeaters, under-eaters, food addicts, anorexics, bulimics, binge eaters and over exercisers. We meet at Knox United Church at 7:30 p.m. Tuesdays in Parksville and at QF Foods Parksville, board room 12:15 p.m. to 1:15 p.m. on Fridays. Info: oaviig.org. Qualicum Beach FamilySearch Centre: Interested in adding to your family tree or finding out more about your grandparents? When you visit the Family Search Centre our volunteers are there to help you. Access to nine major family history websites including Ancestry. The centre is located at 591 Arbutus Rd., Qualicum Beach within the Church of Jesus Christ of Latter Day Saints. It is open every Wednesday from 10 a.m. to 2 p.m. Drop-ins welcome or make an appointment with Liz at 250-586-3575. CFUW PQ: 40th annual book sale donation drop box is located on the side of Save-On-Foods, facing Canadian Tire. We appreciate donations of gently used books and puzzles. For a large donation, please email booksale@cfuwpq.ca. Most of the sale’s proceeds are used for scholarships and other projects supporting women in District 69. Smart Recovery Meetings: Wednesdays at 6:30 p.m. and Saturdays at 10 a.m. at SOS at 245 Hirst Ave. Questions call John at 250-586-3727. Oceanside A Cappella: Welcomes women singers of all ages. Rehearsals every Wednesday from 7 p.m. to 9 p.m. at the Senior Activity Centre in Qualicum Beach. Director Rosemary Lindsey. Info: oceansideacappella@gmail.com. TooHotForCovers and Friends: Song Circle every Saturday at Parksville Legion 49 after meat draw, start 5 p.m. to closing. Info: 250-927-2559.

It’s said that one language dies every day and that roughly 6,000 others are at risk of going silent around the world. But a Victoria company is determined to bring these fading languages back to the forefront and prevent the loss of their culture and history. Language Foundry, formerly known as the Cultural Foundry Studio, is an education technology company with the mission of supporting the revitalization of endangered and at-risk languages worldwide. The startup’s e-learning platform addresses this “urgent cultural challenge” by providing communities with the tools to support language learning and revitalization in culturally grounded and accessible ways, explained CEO Chad Quinn. “We have a number of processes that we’ve developed to enable elders and speakers to record their languages,” he said. “And then, we use that to build a language model so that it can speak the language.” Once the linguistic platform is created, communities retain ownership over the content and data, ensuring cultural safety, sovereignty and long-term stewardship. “Everything is owned by the community because we find that it’s incredibly important for us to make sure that the communities retain ownership of the data,” said Quinn. Working under the invitation of Indigenous communities across Canada and the United States, Language Foundry creates gamified courses that take learners from beginning concepts to basic fluency. Each course is created to reflect the unique cultural identity of its language, from the artwork to syllabic keyboards. “(Students) can see, hear and play with the language as they go and learn more,” he said. “We tried very hard to make it a comforting and warm experience.” With their language platform launched in 2023, Quinn described the response as “amazing.” The platform now offers 14 languages and has over 10,000 students across Canada and the U.S. “It definitely gets you up in the morning,” he said. “It makes you really want to do the hard work of getting this rolling. “When we first started showing it, the emotions were pretty raw in terms of what we’ve heard.” Earlier this November, the company was selected as one of four Canadian startups to participate in the 2025 Web Summit held in Lisbon. Humbled to have been part of this opportunity to connect with investors, fellow entrepreneurs and like-minded professionals, Quinn now wishes to export his services worldwide. To learn more about Language Foundry, visit [https://www.languagefoundry.com/]languagefoundry.com [https://www.languagefoundry.com/].

With an historical Nanaimo building slated for demolition early next year, followed by construction of a new structure, members of Felice Cavallotti Lodge are reflecting on 125 years of existence. Cavallotti Lodge evolved from the Felice Cavallotti Italian Mutual Aid Society, founded on Nov. 4, 1900, by coal miners from Italy with the aim of assisting workers and their families in cases of injury, illness and death, according to historical perspective Days Gone By: Celebrating 125 Years of Cavallotti Lodge History. On the insistence of then-president Siro Rossetto, members contributed $100 each and land on East Wellington Road was purchased in the late ’60s. The current Italian community hall replaced a building referred to as ‘the shack’ and was officially opened in May 1979. In the present, Ian Cumpstone, the lodge’s board president, said the new building will have smaller capacity – the current hall fits close to 200 and its reincarnation between 140-150 – and will still be available for the community to rent. With inflation, the committee had to pivot from a planned two-storey building. “Obviously, prices are so expensive, but our goal as a committee is to future-proof the building so that future generations, once funds become available, decide they can put the second storey on, etc.,” Cumpstone said. “The initial building, we hope to start work mid- to late- next year, will have a hall and a members room, plus the kitchen [and] bathroom.” Building the new lodge is the priority, but ideas for programming, with an emphasis on youths, are being bandied about – membership has declined since the COVID-19 pandemic. “We’re looking at establishing Italian language classes, Italian cooking classes … we are looking at maybe having an exchange program with Italy, where students can come here and we can learn off them, and then our students can go over there,” said Cumpstone. Felice Cavallotti was an Italian politician referred to as the ‘Poet of Democracy’ and someone founders saw fit to honour. “He battled for, not just the poor people in Italy, but he really was a people’s person and when Italy, in the mid- to late-1800s, was going through all its poverty, strife and unrest, he got into parliament as the opposition, and he was a very strong advocate for the rights of the Italians,” said Cumpstone. Concept drawings for the new lodge were designed by noted Nanaimo architect and lodge member, Ian Niamath [https://nanaimobulletin.com/2025/11/05/ian-azard-niamath/], who died in October. Cumpstone expressed gratitude for the contributions. “He did so much work … he was really [forward]-thinking,” he said. “These are his plans and everything that we could possibly want is in here. He wasn’t worried about how much it cost … He said, ‘That’s your job.’ So, it’ll be toned down a bit from this, but the basics of what he wanted and what we want will be in here.” The society was somewhat nomadic at the outset and having its own building allowed it to thrive. “They used to meet all over the place; they never really had a home, and so in the 1950s they bought this parcel of land here,” said the president. “They built a shack, and they mucked around on the shack for a year or two … once the facility was up, things really started to move. They started renting it out to all the different cultural business groups in the community and that still happens today.” Cavallotti Lodge members will be holding a demolition sale at its East Wellington Road site on Dec. 22 beginning at 8 a.m. Anyone can join the society and for more information, visit www.cavallottilodge.ca [https://www.cavallottilodge.ca/].

Going down the rabbit hole should be an experience. It should be something that promises whimsy and delight. That’s exactly what you’ll find at Rabbit Rabbit. Inspired by the metaphor of falling down the rabbit hole, Rabbit Rabbit is a Victoria wine bar and restaurant with an Alice in Wonderland twist. Located at 658 Herald St., the intimate space – about 760 square feet of dining room – packs a memorable punch. The branding was thoughtfully designed by Glasfurd and Walker and brought to life under the guidance of first-time restaurateur and owner, Sydney Cooper. But beyond the pops of bold art and the quirky details (like a painted red chandelier and the rabbit motif tastefully scattered throughout), the approach to food and wine is where the real adventure lies. Chef Billy Nguyen came on board when it opened last fall and has helped bring notoriety to the establishment, notably with Rabbit Rabbit recently listed as a finalist for Air Canada’s Best New Restaurants in 2025. Billy was also the runner-up on Top Chef Canada’s ninth season, competing alongside chef Andrea Alridge, now at Janevca (also a finalist for best new restaurant). But while Billy often felt misunderstood during most of his cooking career due to his flair for out-of-the-ordinary ideas, he says he’s found his place. “Sometimes you have people doubt you so much growing up – and your creativity – and it’s incredible that now people get to eat what goes on in my mind.” Billy is grateful to be given the freedom to let his creativity run wild. “Sydney said to me, ‘Do whatever you want.’” Though trust in one another developed over time, Billy and Sydney said they found kindred spirits in each other when introduced through a friend, James Langford-Smith of Pamplemousse Jus, who acted as a front of house consultant. Both had been through major career changes in their lives. Sydney was previously a policy analyst who did a full 180 to become a restaurateur after her now-husband introduced her to the world of wine at age 40; Billy had been in architecture school. Together, they were ready to create something novel and different. “I felt as though embarking on this huge project, which neither one of us had taken on before, was a positive rather than something to be intimidated by,” Sydney recalls. Her confidence was bolstered by sommelier and wine education through the Court of Master Sommeliers and the Vinica Education Society, plus a job at Marilena Cafe and Raw Bar in Victoria. Then, after trying Billy’s food in Vancouver, she found the missing piece. “Billy has a creative genius that he displays in the most approachable way.” His approach to cooking, a cultural fusion of French techniques with his British and Chinese-Vietnamese roots, was “boundary-pushing,” and “perfectly matched” to how she wants guests to experience wine. Billy’s flair for the comforting yet unconventional can be found in dishes like the popular lasagna with gochujang bolognese or pork and fermented mustard greens dumplings in a smooth sake cream sauce with chili and charred scallion oil and furikake. Billy’s creativity is further brought to life through his plating, influenced by his penchant for design. “I usually visualize what I want a dish to look like before I even create what the dish is. And then I start putting elements I know work together.” It took time for the chef to find a restaurant where he could truly be free to express his culinary ideas. Born and raised in London, he gained experience in West Coast, farm-to-table cooking and butchery once moving to Canada. Notably, he was the former sous-chef of acclaimed Asian-French fusion restaurant PiDGiN, which was, surprisingly, his first career foray into Asian cooking other than cooking at home with family. “I really discovered who I was as a chef when I started working there.” But it was Top Chef Canada and working with Sydney where he has found a new confidence in trusting his creativity and boundary pushing, he says. While Billy brings the whimsy, Sydney ensures it’s grounded in warmth and welcome. Her three-fold approach is to focus on “radical hospitality,” provide an approachable wine experience and provide an escape from the everyday. The wine program removes the “intimidation and pretentiousness” in approaching wine, she says, encouraging guests to explore at their own pace. Now that she deeply understands Billy’s style of cooking, she tailors her selections around what pairs best with his food. That mutual trust has resulted in something refreshingly different – playful food and wine served with an open-armed sense of welcome. “One of my goals for the restaurant is to truly become part of the fabric of the community,” Sydney says. “It should feel as essential as your neighbourhood grocery store.” To bring that vision to life, Rabbit Rabbit has started hosting Monday vinyl nights, curated by Jesse Owens of Hide and Seek Coffee. It’s an evening that caters to both industry friends and regulars, with an inexpensive “staff meal” feature (something “simple but comforting and delicious”) as well as drink specials and flights. “When guests come into Rabbit Rabbit, I want them to have a feeling akin to attending a dinner party at a close friend’s house,” Sydney says. The feedback so far suggests she’s succeeded. “The biggest validation came from my son, who’s 15. We all came in to celebrate one of my daughter’s birthdays, and he said, ‘Mom, your restaurant feels like Christmas.’ I nearly cried.” For the dynamic duo, it all comes back to a sense of wonder and welcome. “I don’t think people go out to dine for food. I think they go out to dine to experience something,” Sydney explains. “And the experience I want to give guests is one of being transported – of escape.”

Santa Claus is coming to town to visit the girls and boys of Nanaimo next weekend. With the sleigh being tuned and reindeer resting ahead of their Dec. 24 journey, Harbour Air has lent an aircraft to Jolly Old St. Nick for a fly-in on Saturday, Dec. 6, the first of his December appearances in Nanaimo. Santa is due to arrive at the Harbour Air dock at 10:30 a.m. on Dec. 6, and will then head to his temporary workshop at 78 Wharf St. He will be at his chair for pictures with children from 11 a.m. to 4 p.m. that day and again on Sunday, Dec. 7 from 11 a.m. to 4 p.m. Santa will be at the workshop Tuesday, Dec. 9 from 4-7 p.m. to spend time with children with mobility or cognitive issues and on Thursday, Dec. 11 from 4-7 p.m. for pictures with pets. His last two appearances for 2025 will be Saturday, Dec. 13, from 10 a.m.-4 p.m., and Sunday, Dec. 14, from 11 a.m. to 4 p.m. RBC Dominion Securities is sponsoring the event and while there is no admission, donations will be accepted for the Make-A-Wish Foundation.

Nanaimo’s RCMP officers will be out in force to support the community’s less fortunate families this holiday season. Officers with Nanaimo RCMP’s youth section will be collecting donations for their Cram the Cruiser drive in front of the Woodgrove Centre Save-On-Foods on Saturday, Dec. 6, to help Nanaimo’s families in need. The event runs 10 a.m. to 2 p.m. when officers will be standing by to collect donations of toys, non-perishable food items and gently used clothing and footwear. Nanaimo RCMP’s youth section members work in the city’s schools to build relationships with students to foster a sense of safety and belonging, a Nanaimo RCMP press release noted. “Having police officers in our schools is vital,” said Const. Sherri Wade, Nanaimo RCMP spokesperson, in the release. “They cultivate safe, positive connections that can last a lifetime.”

The junior Barsby Bulldogs are provincial champions. John Barsby Secondary School’s AA junior varsity football team won the B.C. High School Football championship, defeating the Argyle Pipers by a 34-3 score on Saturday, Nov. 29, at McLeod Stadium in Langley. “We started fast and kept our foot on the throttle the whole time…” said Rob Stevenson, the team’s coach. “We played one of our most complete football games.” He said the Bulldogs knew the Pipers had tremendous skill position players, but also knew that the ‘Dawgs had the better offensive and defensive lines and could win at the line of scrimmage. Barsby’s defence came ready to shut down Argyle’s best plays, and only gave up one big play all game. Meanwhile, Barsby’s offence echoed the defence’s physical tone and played to its strengths with a ball-possession game. “It started with preparation all week – basically all year,” Stevenson said. “We were building ourselves to be able to play this type of football game.” He said his team was fundamentally sound, blocking and tackling well and benefiting from the effort they put in on the blocking sled and in the weight room. “To culminate with a game like we played was immensely satisfying and I think it was felt not only be the coaching staff but certainly by the players,” he said. James Coco was chosen game MVP after scoring touchdown runs of 21 yards and five yards. Adyson Lloyd-Walters, chosen outstanding back, opened the scoring with a 29-yard touchdown catch from Baraka Gibson. Gibson also connected with Andrew Wright on a 20-yard TD reception and Barsby’s other TD was a four-yard run from Nathen Wilson. Stevenson thanked Bulldogs parents, alumni and other supporters for being the “loudest voices” in the stadium that day. In other football news, South-Side Minor Football’s junior bantam team won the provincial championship with an 18-16 win against Cloverdale on Sunday, Nov. 30, in Victoria, and South-Side’s peewee team also made it to the championship game this past weekend, finishing as runners-up.

It has stood for more than a century in testament to Victoria’s proud military history, but now the Bay Street Armoury will take on the name of a military figure whose history stretches back even further. The iconic building at 715 Bay St. will be renamed the General Sir Arthur Currie Armoury at a ceremony on Friday (Dec. 5). The date also marks the 150th anniversary of Currie’s birth (1875–1933), whose leadership helped define Canada’s role in the First World War. “Currie was born near Strathroy, Ont. and moved to Victoria in 1894. He was not a career military officer by upbringing or profession. He began his working life as a schoolteacher in Sidney and Victoria and went on to be a real estate developer and insurance salesman,” according to a release from the 5th (BC) Field Artillery Foundation. He rose through the ranks, and just before the First World War, Currie gave up his artillery command and was appointed commander of the 50th Regiment (Gordon Highlanders of Canada). “During the Great War, Currie served first as a brigade and then as a divisional commander, demonstrating a consistent commitment to strategic preparation and the careful protection of the lives of his soldiers. In 1917, he became the first Canadian-born officer to command the 100,000-strong Canadian Corps, leading it through some of the most significant operations of the war. Under his leadership, Canadian forces earned a reputation as one of the most effective and respected formations on the Western Front,” said the release. “Currie’s meticulous planning and insistence on realistic training played a central role in the Canadian success at Vimy Ridge, a battle that has come to symbolize Canada’s emergence as a nation. His leadership during the Hundred Days Offensive in 1918 helped bring the war to its conclusion, with the Canadian Corps often assigned the most difficult and strategically vital objectives.” After the war, Currie went on to serve as principal and vice-chancellor of McGill University. “In renaming the Bay Street Armoury, we honour a local son who rose to become one of the most respected military leaders of his time. But we also honour what he stood for: thoughtful leadership, responsibility in command, and the belief that Canada could and should define its own destiny,” states the 5th (BC) Field Artillery Foundation. The Bay Street Armoury was built in 1912-1914 and is a recognized federal heritage building because of its historical associations and its architectural and environmental value. “The Bay Street Armoury is a large structure whose form and detailing conjure up the images of a fortress through the incorporation of towers, crenellated turrets and a low wide arched entrance, reminiscent of a fortified gate,” according to the Parks Canada federal heritage designation. “The Bay Street Armoury is a very good example of an armoury designed in the Tudor Revival style with references to medieval military architecture.” Friday’s commemorative celebration will run from 10 a.m. to 3 p.m. and feature military displays by the 5th (BC) Field Regiment RCA and The Canadian Scottish Regiment. At about 12:30 p.m., there will be a birthday tribute reception to Sir Arthur Currie by unveiling a plaque to rename the armoury in his honour and a ceremonial cake cutting with Alan Lowe and John Ducker, honorary colonels of The Canadian Scottish Regiment and 5th (BC) Field Regiment RCA. The free event will also feature displays by Valour Canada, Ashton Armoury, BC Aviation Museum, District of Saanich Archives, Victoria Esquimalt Re-enactors Society, Royal Canadian Legion, Sidney Museum and Archives, Fort Rodd Hill Historic Site, Friends of Macaulay, Municipality of Esquimalt Archives, District of Oak Bay Archives, Vimy Memorial Photo Display, Craigdarroch Castle and the Canadian Scottish Women’s Auxiliary Concession.

While some may find it difficult to welcome colder months by turning back the clocks and settling into earlier darkness, one Oak Bay tradition always brings light back to the streets – and to the hearts of Greater Victoria residents. Celebrating a quarter of a century, the Oak Bay Light Up marks its 25-year anniversary, heralding the coming of the Christmas season. Taking place on Oak Bay Avenue between Wilmot Place and Monterey Avenue, the fun began at 2 p.m. with crafts, games, street food and entertainment. The event offered a wide range of free, family-friendly options, including letter-writing to Santa, a hula-hoop tent, a drawing station, a wreath-making area and more. Throughout the afternoon, spectators enjoyed live music from various artists and groups, including the Whoville Children’s Choir, the BC Fiddle Orchestra, Oak Bay High’s jazz combos and the Joy of Life Choir. This kept the little ones busy leading up to the heart of the event, the official light up at 5 p.m., when the ceremonial plugs were connected to illuminate the buildings, lampposts and trees along a section of Oak Bay Avenue. Shortly after, both Santa and Mrs. Claus made an appearance to greet the crowd and pose for photos. Orchestrating the event was Heather Leary, who said the celebration has always had community at its core. “There’s lots of stuff for families to do and enjoy the start of the season,” she said. “We take pride in it being free, so people can come and really just enjoy being in the community.” Taking root at the turn of the millennium, Leary explained that the event began with Matt McNeill, owner of the Penny Farthing Pub, and other local business owners who wanted to bring some happiness during hard times. “They got together and wanted to do something to bring some cheer to the community after the tragedy of 9/11,” she said. “The idea was to bring some light to the darkness and to have an event that would kick it all off.” Rapidly becoming a community favourite, Leary said this year’s turnout was excellent, with several thousand people attending. “We were expecting a good crowd because I’d been hearing all month, as the lights were being put in, that people couldn’t wait for the lights to come on and for the village to be lit up,” she said. Laura Balcarras and her two children were among the attendees, and the celebration is marked on their calendar every year. “Every year we like to come to this event because it’s quite magical, especially when Santa comes in,” she said. While the event takes a considerable amount of time and energy each year, Leary is proud to welcome the public year after year to an event that wouldn’t be possible without the broad support of the community. “It’s driven by the business community, but it’s well supported by the fire department, the police department and suppliers who come and bring their A-game,” she said.

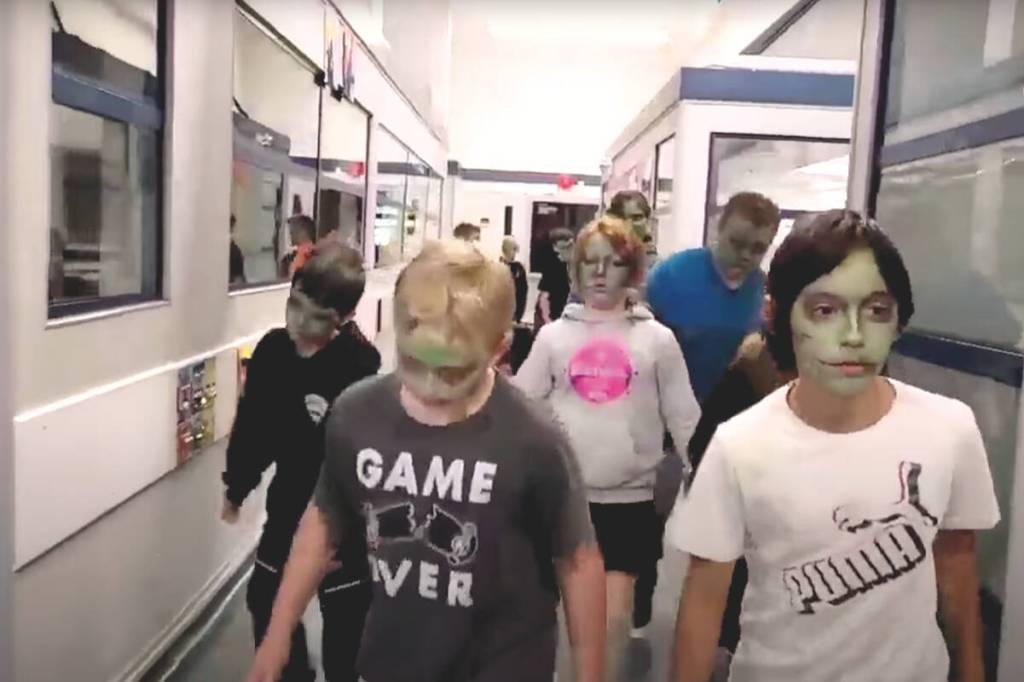

Sayward Elementary School was briefly a film set for a zombie movie. The school hosted students from Carihi Secondary’s video productions class for two days, as the two schools collaborated on making a zombie movie featuring actors from both schools. Safe Zone: A Zombie Film is “an amazing collaboration between schools,” said Joe Shields, the Carihi video productions teacher. “My senior students got to direct and film the Sayward film students, and the Sayward students got to experience filmmaking,” said Shields. “Not to mention the staff of Sayward School let us turn their school into a film set for two days.” The Sayward PAC supported the project by providing meals and supplies. Nolan Clark, one of the actors in the film, said it was a really good experience, but admitted to being nervous at times. He said that everything worked out in the end. It was the first time he had acted on screen, but he had been acting for two years in his drama class. Spencer Montgomery was one of the camera operators. He calls the experience fun, but stressful. “Only having two days to get a whole movie done was a lot of work, but I’m glad we managed to make it work,” he said. The Carihi film class arrived at Sayward around 11 a.m. the first day and didn’t leave until five p.m. the day after. Montgomery also said filming with Sayward’s Grade 4 students went well. “I was very surprised. Most of the Grade 4 students portrayed zombies, except Eddie Robson, who played a survivor with Clark and another Carihi student, Kayden Clinton. Shields said the whole project came together after a discussion with Sayward Principal Kai Taylor about how the school has 43 students, but is designed for 300. It was also borne out of an idea for the Sayward students to meet some Carihi students. The majority of students in Sayward will end up at Carihi during their high school years. Some of those students are nervous about getting on a bus and going to the “big city.” So they used this film set as a learning opportunity and had the Sayward students meet their high school counterparts face-to-face. “These kids aren’t that scary, and what better way to make them not be scared but make a zombie movie with them? So we went up there with the attitude of collaborating with these young students so they would come to see that these guys are safe and fun,” said Shields. Taylor said he wanted to make connections with other schools so his students are ready and can protect themselves when they move on to new schools, likely to Phoenix and then Carihi. “The kids loved it,” he said. “Particularly the older ones. We focused on the older class because they are the ones who are going to be making the transition to Phoenix…They leaned into it. They loved it.” Safe Zone had its premiere on Nov. 13 at the Timberline Secondary School theatre. Other Carihi students involved in the film include Tim Hardy (camera), Edwin Clements (camera), Indy Cook (director), Steven Jordan (sound), Rex Bailey (sound), Gabriel Felipe (sound), Rylee Dejong (make up), Breanna Gyles (make up), and Jaiden Copenance (make up). Additional adults who helped make the film come to life include Melissa Cada, Brenna Robson, Catherine Clinton, and Sean McLaughlin. Timberline’s Brennan Hagen, Jana McFarlane, and Laird Ruehlen helped with the screening on Nov. 13.

What is really happening in Sooke? Many residents are troubled by persistent rumors that our elected officials have already decided to adopt the draft official community plan (OCP), even as our mayor calls us to a public hearing – now the third time in five years, for the exact same proposal that has repeatedly been rejected by our community. The message from the public is clear: this document does not reflect Sooke’s needs. Instead, it comes from outside consultants who seem unfamiliar with our local concerns. It reads as boilerplate language with little customization for Sooke. Moreover, important promises remain unfulfilled. Previously, community members voiced strong concerns that the development permit applications (DPAs) were confusing, lacked transparency, and left property owners uncertain about their rights. Residents specifically requested that new bylaws should only affect new builds, rezoning, or undeveloped land – not existing single-family homes. Mayor Tait and council assured us that there would be no expropriation of private lands, including foreshore properties, and that the DPAs would be clarified or removed. It’s worth noting that the Sooke basin and foreshore are already strictly regulated by provincial and federal agencies. Additional local regulations do nothing to address the serious affordability crisis facing our community. Instead, they will drive up costs, worsen affordability, and make obtaining permits more difficult. Builders and families already face long delays; more bureaucracy will mean more staff, higher administrative expenses, and ultimately offset any potential permit revenue. Real revenue comes from major projects – new builds or development of bare land – not from regular families, but from ultra-wealthy developers. What’s especially troubling is that, despite ongoing opposition, the district has targeted waterfront properties three times in five years yet has failed to notify affected owners directly. Each time, the same proposals are recycled, without meaningful changes or engagement. The transparency issues identified in previous hearings persist. Such practices show a lack of accountability and respect for taxpayers. Why is the district disregarding previous council and mayoral instructions, and why aren’t our leaders standing up for Sooke residents? Matt Mortenson Sooke

One Canadian every 10 minutes is diagnosed with vision loss – but that doesn’t necessarily mean they have to lose independence. Living safely and independently with vision loss was the subject of a talk by Evaleen Baker at the Nanaimo Seniors Services Network’s Seniors Health Fair last month. “It’s not a death sentence to get diagnosed with an eye condition. I know we put a lot of emphasis on our eyesight, but we’re here to support that independence,” Baker said. “I don’t want to see people missing out on any activities because of vision, the only thing I can’t do is restore one’s driver’s licence.” Baker is a certified low vision specialist with Vision Loss Rehabilitation Canada, a not-for-profit that helps Canadians with vision loss live safely and independently at no cost to the person. For Baker, that means being a part of equipping more than 6,000 people on Vancouver Island with the skills they need to move about independently, a career she started after seeing how the health system in Ontario treated blind patients. “We truly didn’t understand vision loss. I would get doctor’s orders – go in, feed, dress, medicate, look after these people – and the only thing wrong with them is they didn’t see. I was like, ‘this is awful, why are we doing this to you? Why don’t you get up and we’ll do it together?’” After going back to school to focus on supporting patients with vision loss and being hired on with Vision Loss Rehabilitation Canada, a large part of Baker’s job now is introducing aids to patients, whether that’s using different smart device apps, helping them learn to cook again or figuring out grooming routines. “People don’t tend to go blind the way we misunderstand. It’s 10 per cent of our clientele that go totally blind. Ninety-per cent of our clients always have some degree of functional eyesight to work with and that is the misconception in the general public,” Baker said. “They see it as a black-and-white issue. It’s definitely not.” She said most vision loss is gradual, presenting the opportunity to learn to adapt along the way. Macular degeneration remains the most common form of vision loss, especially prevalent in those over 50. The macula is the part of the eye focusing on fine detail at the front of the eye, but macular degeneration worsens that field of vision without impacting peripheral vision. This means that while the person may not be able to make out the details, they can walk into a room knowing if there are people or objects. For those experiencing vision loss who still have partial sight, one of the first things Baker recommends is task lights. “The more light we can position on top of a task, often it is quite enhancing and more contrasting and much easier to access. By age of 50 and getting older, most people want more lighting. They start turning on more lights and I always talk about that light: get that light into a goose-neck or a flexible arm, get that light positioned on top of the task and away from the face, and that can really make a significant difference.” Contrast in colour can also be useful. Black coffee in a black coffee mug or white plates on a white tablecloth might be difficult to distinguish, for example. “I always tell people, watch where you lay objects, watch for where your surfaces are, look f0r different types of contrast,” Baker said. “There are ways of enhancing contrast, people will do it on the phone.” Sunglasses are another tool, both for reducing eye damage to begin with, as well as for assisting those who require added contrast. The key is finding the right tint for the environment. For those who don’t yet have vision damage, Baker said not wearing sunglasses in sunlight is “the fastest, easiest way to lose eyesight.” All sunglasses sold in Canada are required to provide UV protection, regardless of price, but if the product is bought from outside of Canada, it might not have the same protection. Seeing an optometrist for an eye exam every two years is also recommended. Baker said Vision Loss Rehabilitation Canada prefers to work with the clients as soon as a diagnosis is received, whether by self-referral or medical recommendation. “The doctors get pretty fixated on how they’re going to fix this or what they are going to do for it, but they don’t really think about how this person is managing once they leave the doctor’s office,” she said. “Once that diagnosis comes in, it doesn’t matter one’s visual acuity, I’ll meet people who are driving at 20/20 but they have been diagnosed and they need that support.” For more information, visit http://visionlossrehab.ca. [https://visionlossrehab.ca]

It’s said that one language dies every day and that roughly 6,000 others are at risk of going silent around the world. But a Victoria company is determined to bring these fading languages back to the forefront and prevent the loss of their culture and history. Language Foundry, formerly known as the Cultural Foundry Studio, is an education technology company with the mission of supporting the revitalization of endangered and at-risk languages worldwide. The startup’s e-learning platform addresses this “urgent cultural challenge” by providing communities with the tools to support language learning and revitalization in culturally grounded and accessible ways, explained CEO Chad Quinn. “We have a number of processes that we’ve developed to enable elders and speakers to record their languages,” he said. “And then, we use that to build a language model so that it can speak the language.” Once the linguistic platform is created, communities retain ownership over the content and data, ensuring cultural safety, sovereignty and long-term stewardship. “Everything is owned by the community because we find that it’s incredibly important for us to make sure that the communities retain ownership of the data,” said Quinn. Working under the invitation of Indigenous communities across Canada and the United States, Language Foundry creates gamified courses that take learners from beginning concepts to basic fluency. Each course is created to reflect the unique cultural identity of its language, from the artwork to syllabic keyboards. “(Students) can see, hear and play with the language as they go and learn more,” he said. “We tried very hard to make it a comforting and warm experience.” With their language platform launched in 2023, Quinn described the response as “amazing.” The platform now offers 14 languages and has over 10,000 students across Canada and the U.S. “It definitely gets you up in the morning,” he said. “It makes you really want to do the hard work of getting this rolling. “When we first started showing it, the emotions were pretty raw in terms of what we’ve heard.” Earlier this November, the company was selected as one of four Canadian startups to participate in the 2025 Web Summit held in Lisbon. Humbled to have been part of this opportunity to connect with investors, fellow entrepreneurs and like-minded professionals, Quinn now wishes to export his services worldwide. To learn more about Language Foundry, visit [https://www.languagefoundry.com/]languagefoundry.com [https://www.languagefoundry.com/].

Regarding the idea of adding yet another expensive crosswalk to serve the patrons of Mary’s Blue Moon Cafe, I would point out that there is already a nearby crosswalk if the patrons can be bothered to take the extra steps to use it. I often drive along there and am always aware of the people who are exiting their vehicles and heading across the road, sometimes without even looking. Yes, it’s a hazard, but (no pun intended) it’s a two-way street: pedestrians take care, drivers take care. Don’t worry, your burger and fries will still be hot by the time you get them. Mike Trainer North Saanich

Few cases puzzle VicPD detectives as much as the disappearance of Emma Fillipoff, now marking 13 years without answers. The 26-year-old was last seen on Nov. 28, 2012, walking barefoot nearby Victoria’s Empress Hotel on Government Street. On the night she vanished, officers checked on Fillipoff around 7 p.m. after an acquaintance who saw her on a street corner expressed concern about her state. After a brief conversation, the officer left, noting she appeared safe at the time. Shortly after, her van was located in a nearby hotel parking lot. Inside were most of her belongings, including her passport, laptop, journals, camera, and recently borrowed library books. In a press release, VicPD noted that Fillipoff appeared to be experiencing “the onset of mental health challenges.” While Fillipoff’s story remains unresolved, her case is now with VicPD’s Historical Case Unit and the investigation is still ongoing. For her mother, Shelley Fillipoff, the 13th anniversary is a painful reminder of the years that have slipped by. While each Nov. 28 brings renewed grief, she reflects the hope she held early on, believing it was only a matter of time before she and daughter were reunited. “As time wore on, keeping that hope alive became more difficult,” she said. Despite the years, she continues to cling to that hope, drawing strength from her three other children, who keep her grounded. “Without it, I have nothing,” she said. Shelley shared that a new six-part series, Barefoot in the Night, will launch on Emma’s 40th birthday. Aiming to renew public awareness of the case, it will premiere on Jan. 6, 2026. More information and ways to help in the search can be found at helpfindemmafillipoff.ca. Details about Fillipoff’s disappearance and other Canadian missing person cases are available on the RCMP’s National Centre for Missing Persons and Unidentified Remains website.